|

| Qualcomm ready to invest in Arm |

US chip giant Qualcomm said it would be open to investing in Arm if regulators block its $40 billion sale to Nvidia.

Qualcomm's new CEO, Cristiano Amon, said Qualcomm would be willing to buy Arms stock along with other industry investors if current Arm owner SoftBank listed the company rather than selling it to Nvidia.

Amon added: “If Arm had an independent future, I think you would find that many companies in the ecosystem (including Qualcomm) would be interested in investing in Arm.

Amon noted that Qualcomm is open about this and has spoken with other like-minded companies.

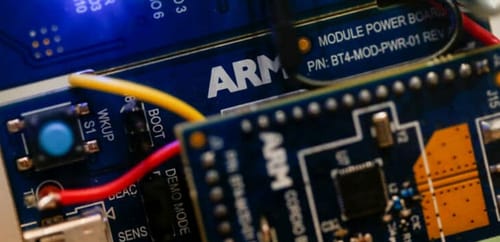

Arm was born in 1990 from one of the first computer companies named Acorn Computers. The company's energy-efficient chip architecture is used in 95% of smartphones in the world and 95% of chips developed in China.

The company licenses its chip designs to more than 500 companies that use them to manufacture their own chips.

An Nvidia spokesperson said Arm needs more than an initial public offering to reach its full potential. Arm needed new technology that could be shipped to Arm Licensors anywhere, which is why we agreed to buy Arm. Our technology is integrated into Qualcomm, and we appreciate your assistance in developing new technologies and products for the entire Arm ecosystem.

arm receiver:

The two companies announced in September last year that Nvidia had acquired the British company, and implementation is expected to take about 18 months.

Since then, Qualcomm has told regulators around the world that it opposes the deal, as have Microsoft and Google.

The two companies have spoken out against the takeover because Nvidia could take control of the British company's technology and prevent other chip makers from taking advantage of the company's intellectual property.

The company wonders if Nvidia can take full advantage of the acquisition without denying the British company's chip design.

Nvidia claims to maintain an open arm licensing model. But the Federal Trade Commission, the European Commission, the UK's Competition and Markets regulator, and China's State Administration for Market Regulation are investigating the deal.

The British company has set up a joint venture called Arm China with Chinese private equity firm Hopu Investment.

Arm China is headquartered in Shanghai. This means that the Chinese Ministry of Commerce and the Chinese state market regulator have the right to review transactions.

In the past few weeks, Nvidia has asked Chinese regulators to approve the deal, saying the regulatory process is confidential. But he still has the confidence to get approval and close the deal in early 2022.